Money Management

Managing money is a critical part of education that is mostly ignored by our schools. Maybe that is one reason around half of the American households have no retirement savings. Zero! So as parents, we must be responsible for teaching our kids a lesson on economic survival. The sooner they learn the basics of earning, spending, and saving, the better off they will be. Be their best advocate by celebrating their accomplishments, helping them overcome challenges, and cheering them on. So what else can you do?

Before kids can learn to manage money, they have to get some. You could start with the money they get as gifts. Let them spend half and set the rest aside for something bigger. That teaches them the discipline of saving up money for the things they want instead of buying on credit. Small amounts add up over time, and watching money grow will support the practice of consistent saving.

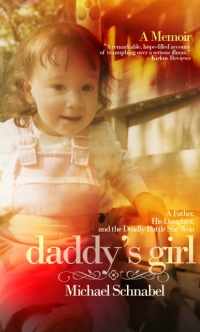

Consider matching what the kids put into savings to motivate them to save more. My daughter enjoyed watching the numbers grow, and the bank paying her interest. When her account reached $1,000, I asked my financial planner to enlighten her about investments, risk, debt, and how time impacts the way money grows. I read somewhere that the best time to plant a tree was twenty years ago. That's because it takes time for it to grow into the tree you want. Start saving early, because money also takes time to become what you want.

Keep your kids working. Have them do chores, babysit, or mow lawns. Working different jobs helps them understand the importance of showing up on time, doing their best, and learning new skills. These experiences will help motivate them to seek out work that is more enjoyable and financially rewarding. Have them consider saving the money they get with a raise or a bonus. Its money they haven't had before, so they may not miss it. Encourage their work with positive comments and appreciation for what they are doing. Help them understand there is no such thing as a free lunch.

Involve your offspring in sports, scouting, theater, and a variety of school activities. These programs will help them learn how to work in teams and express their ideas while getting exposure to new experiences and people. They will develop better social skills and recognize how learning and skill development can be fun and help them grow. These experiences will pay dividends in the workplace. They may even uncover a passion for something new in their lives.

Higher education and specific skill development can open the doors to better job opportunities with higher pay, benefits of insurance, and 401K accounts. Talk to your kids about their future. Ask them what they want to do with their lives. What is their passion? Teach them how skill development and education can help them achieve their goals in today’s competitive world.

Train your kids that a credit card is for convenience and not for a loan. The amount due must be paid in full at the end of each month, or they will pay outrageous interest rates. According to the Federal Reserve and Census Bureau data, in 2019, credit card debt increased by 6% to $6,849 for the average US household.

So how do you begin to create wealth? Work hard. Educate yourself and develop new skills to get better jobs. Begin saving early in your life, so time helps your money grow. Discipline yourself to consistently save every month for rainy days, retirement, and specific goals. Always spend less than you earn. Find ways to make your savings work as hard as you do through safe investments. Developing good money management habits early in life will change your future.

Thanks for reading. I try to post every other week at authormichaelschnabel.com/blog. Please share my website with others who may enjoy it. Your comments are appreciated and encouraged.